- Home

- About Us

- Accounting Services

- Registration Services

- Insurance Services

- Financial Services

- Contact Us

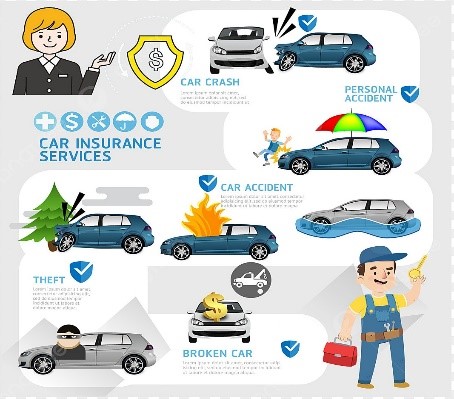

Moter Insurance

Car Insurance Policy || Bike Insurance Policy

Vehicle insurance is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.

If you own a vehicle, you will know that motor insurance is mandatory in India. The policy ensures that the vehicle has complete protection against physical…

Motor insurance is a type of insurance that covers the financial losses that may arise due to the use of a motor vehicle. It is mandatory for all vehicles in India, as per the Motor Vehicles Act, 1988

There are two types of motor insurance:

Third-party insurance: This type of insurance covers the legal liability of the policyholder in case of an accident involving a third party. This means that if the policyholder’s vehicle causes damage to another person’s property or injures another person, the insurance company will pay for the damages or medical expenses.

Comprehensive insurance: This type of insurance covers the policyholder’s own vehicle as well as the legal liability of the policyholder. It also covers damages to the vehicle due to theft, fire, natural disasters, and other events.

Motor insurance is important for a number of reasons:

It protects you from financial losses in case of an accident.

It helps you to comply with the law.

It gives you peace of mind knowing that you are covered in case of an accident.

It can help you to get your vehicle repaired or replaced quickly and easily.

When you are choosing a motor insurance policy, it is important to compare different policies and choose one that meets your needs and budget. You should also make sure that the policy you choose is from a reliable insurance company.

Here are some of the benefits of having motor insurance:

Financial protection in case of an accident: Motor insurance can help you to pay for the cost of repairs to your vehicle, medical expenses for any injuries you or others sustain in an accident, and legal fees.

Compliance with the law: Motor insurance is mandatory in India, so if you are caught driving without it, you could be fined or even imprisoned.

Peace of mind: Knowing that you are covered in case of an accident can give you peace of mind and allow you to drive without worrying about the financial implications.

Quicker repairs: If you have comprehensive motor insurance, your insurer will usually arrange for your vehicle to be repaired quickly and easily, without you having to worry about the costs.

If you own a motor vehicle, it is important to have motor insurance. It is a legal requirement and it can provide you with financial protection in case of an accident. There are many different motor insurance policies available, so you can choose one that meets your needs and budget.