- Home

- About Us

- Accounting Services

- Registration Services

- Insurance Services

- Financial Services

- Contact Us

Life Insurance

LIC's Jeevan Lakshya Click Here

insurance

insurance

insurance

insurance

insurance

insurance

1. LIC Jeevan Lakshya Plan 933

2. LIC new Jeevan dhara 2 plan no 872

3. LIC Jeevan Anand 2 plan no 915

4. LIC Jeevan Labh Plan 936

5. LIC Jeevan Labh Plan 936

6. LIC Jeevan Umang Plan 945

7. LIC Jeevan Utsav Plan 871

8. LIC Jeevan Tarun Plan 934

9. LIC Money Back Plan 921

10. LIC Money Back Plan 920

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment.

Life insurance is a type of insurance that provides financial protection for your loved ones in the event of your death. When you buy a life insurance policy, you agree to pay a premium to the insurance company. In return, the insurance company promises to pay a death benefit to your beneficiaries when you die.

The death benefit can be used to pay for your funeral expenses, outstanding debts, and other financial obligations. It can also be used to provide financial support for your loved ones, such as to help them pay for their mortgage, child’s education, or other expenses.

Life insurance is important for a number of reasons:

- It provides financial security for your loved ones: If you die unexpectedly, your loved ones may be financially devastated. Life insurance can help to ease their financial burden and ensure that they have the money they need to pay for their expenses.

- It can help to protect your assets: If you die without life insurance, your assets may be subject to probate, which can be a costly and time-consuming process. Life insurance can help to avoid probate by ensuring that your beneficiaries receive the death benefit directly from the insurance company.

- It can help to reduce your taxes: The death benefit from a life insurance policy is typically not taxable to your beneficiaries. This can be a significant financial benefit, especially if your beneficiaries are in a high tax bracket.

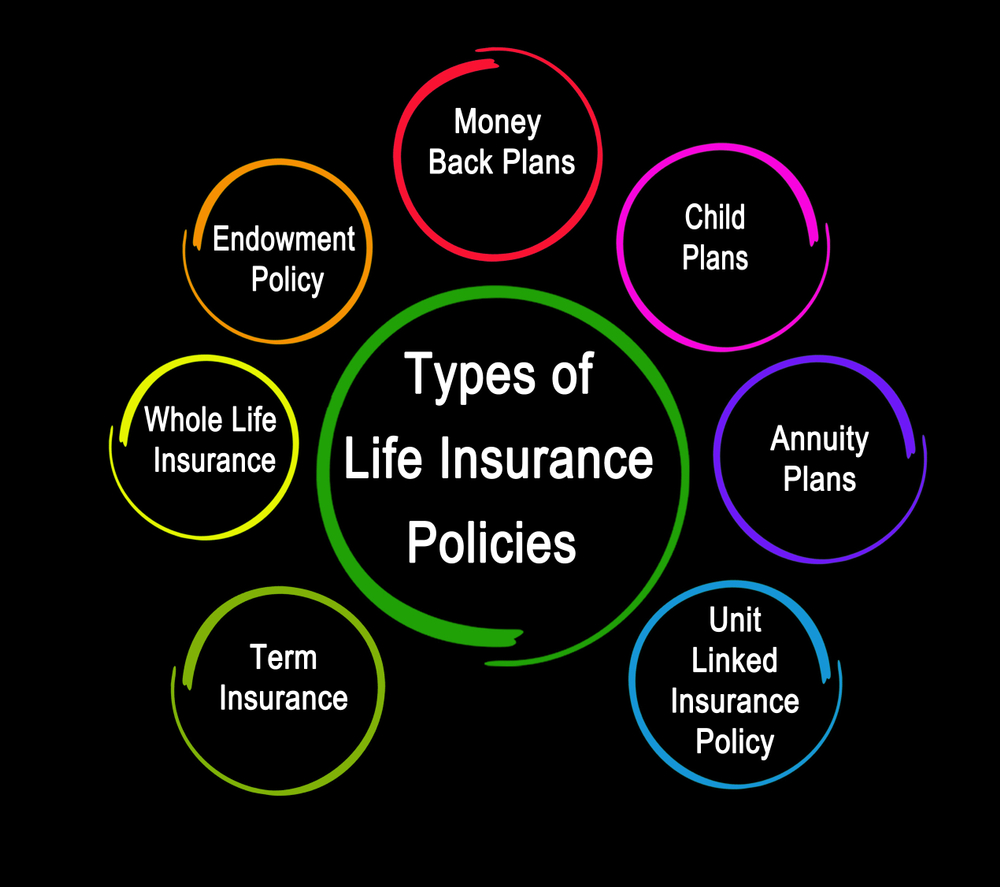

There are many different types of life insurance policies available, so you can choose one that meets your needs and budget. Some of the most common types of life insurance policies include:

- Term life insurance: This type of life insurance provides coverage for a specific period of time, such as 10 or 20 years. It is a good option if you need temporary financial protection, such as to pay off a mortgage or college tuition.

- Permanent life insurance: This type of life insurance provides coverage for your entire lifetime. It is a good option if you want to create a long-term financial legacy for your loved ones.

- Whole life insurance: This type of permanent life insurance accumulates cash value over time. This cash value can be borrowed against or withdrawn, depending on the terms of the policy.

- Universal life insurance: This type of permanent life insurance allows you to adjust the death benefit and premium payments over time. This can be a good option if your financial situation changes.

When you are choosing a life insurance policy, it is important to compare different policies and choose one that meets your needs and budget. You should also make sure that the policy you choose is from a reliable insurance company.

Here are some of the things to consider when choosing a life insurance policy:

- The type of coverage you need: Make sure the policy covers the amount of death benefit you need to provide financial security for your loved ones.

- The term of the policy: If you need temporary financial protection, such as to pay off a mortgage, you may want to choose a term life insurance policy. If you want to create a long-term financial legacy for your loved ones, you may want to choose a permanent life insurance policy.

- The premiums: Make sure you can afford the premiums for the life insurance policy you choose.

- The surrender charges: Some life insurance policies have surrender charges, which are fees you have to pay if you cancel the policy early. Make sure you understand the surrender charges before you choose a policy.

It is also important to read the policy carefully before you purchase it so that you understand what is covered and what is not. You should also contact your insurance company if you have any questions about the policy.